Nowadays, Fannie mae and you will Freddie Mac computer, that are congressionally chartered stockholder-owned enterprises, have faced a number of accounting and you may financial issues. Together, these issues added of a lot in Congress to summarize you to definitely Federal national mortgage association, Freddie Mac, plus the FHLBs you need a healthier regulator. P.L. 110 – 289 creates the new Government Property Funds Department (FHFA) as the newest regulator on the property GSEs, substitution work out of Government Houses Corporation Supervision (OFHEO) while the Government Property Fund Panel (FHFB). The job out-of setting mission wants is transferred to FHFA regarding the fresh Company off Casing and you may Metropolitan Advancement (HUD). 3

P.L. 110 – 289 offers FHFA greater authority to regulate the brand new construction GSEs. FHFA is offered the burden to examine in order to accept the brand new types of mortgages. FHFA is actually offered the legal right to take over and rearrange an insolvent Federal national mortgage association or Freddie Mac and therefore expert was applied for the Sep seven if the FHFA placed Fannie mae and you can Freddie Mac under conservatorship. 4 The fresh FHFA have higher expert to create capital standards for the fresh new property GSEs. FHFA may now need to have the GSEs to throw away possessions and maximum its collection versions.

FHFA also offers broad regulating efforts along the FHLBs, and that is required by rules to determine the distinctions between Fannie Mae and you will Freddie Mac computer plus the FHLBs. Including, each other organizations have to remain, while new several FHLBs is merge, and you can FHFA is require FHLBs so you can merge. FHFA has all of the efforts of one’s FHFB, and that formerly managed this new FHLBs, in addition to conservatorship and you will receivership.

In case of home loan and economic field issues, P.L. 110 – 289 offers the Assistant of your Treasury the ability to give or purchase as frequently money due to the fact wanted to the brand new controlled agencies in order to place the brand new terms of the mortgage. So it expert expires . Brand new Congressional Funds Office (CBO) possess estimated this new questioned government financial costs at $25 billion according to a below fifty% likelihood of Treasury being forced to make use of this expert through to the expert expires at the conclusion of . 5 As the Treasury enjoys invoked so it expert, CBO guess implies a supposed cost of $fifty billion or more. CBO projected that there is nearly a great 5% opportunity the loss carry out full over $100 billion. New act authorizes the Government Put aside and you can Treasury to visit FHFA toward safety and you can soundness facts plus use of the loan power.

Hope for Home owners

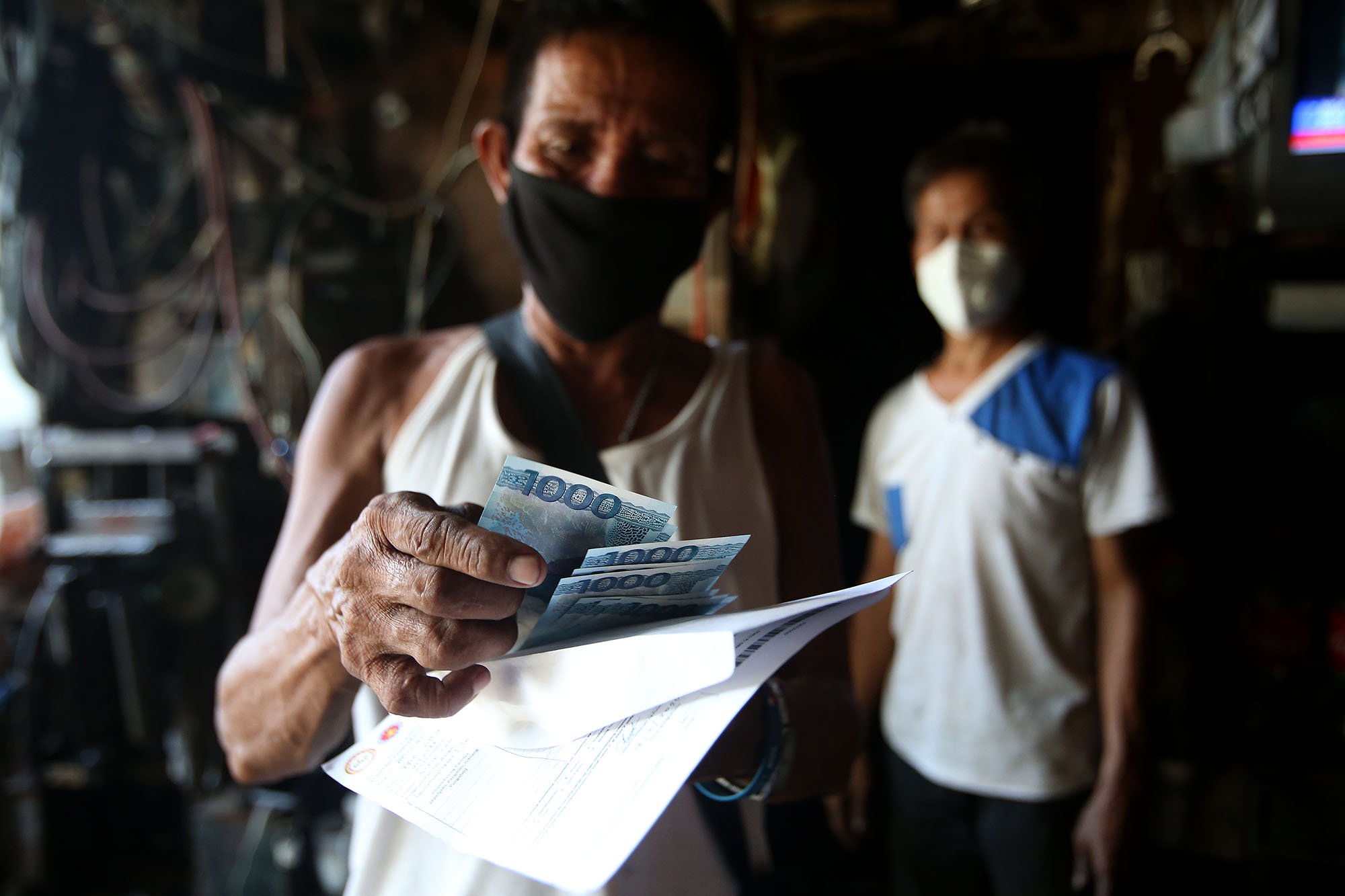

Questions more than ascending prices from delinquency, default, and foreclosures as well as other mortgage business conditions caused specific people to look for a way to let home owners that within risk of shedding their homes. The latest work produces a volunteer system having an authorization amount of $three hundred billion in FHA-covered mortgage loans to refinance mortgages out-of home owners unable to shell out the current mortgage loans. 6 Homeowners which satisfy particular standards normally re-finance towards the good FHA-insured home loan in the event the newest financial(s) agrees to type-along the dominant of your own latest financing to achieve a beneficial ninety% loan-to-value ratio and also to spend a beneficial step 3% premium. CBO systems one 400,000 property owners with $68 billion during the the fresh new mortgages usually takes advantageous asset of this option. eight

Financial Certification

Poor enforcement oversight out of home loan originators in a number of says in addition to not enough such as for instance guidelines various other says have both made it tough to grab lawsuit against people who presumably violated certain state and federal statutes. Also, it offers made it difficult for mortgage originators to investigate fully the backdrop of men and women that they are provided choosing. This new work aims which will make uniformity in the financial creator licensing and you can membership. It can improve creation of a nationwide databases off home loan originators. Brand new work encourages states to grow a system in order to license and you will check in whoever starts a mortgage. 8 HUD loans Heritage Village is to manage a backup program, that would pertain inside the states you to don’t meet the requirements on the label.