Maker out-of SoCal Virtual assistant Belongings

A good Va financing Preapproval within the finest mode are a genuine conditional dedication to give, given away from good Virtual assistant loan underwriter, helping a lender. After you have reached your own Virtual assistant mortgage preapproval, you may be in fact prepared to buy and you may romantic fast, provided the home suits brand new lender’s requirements.

However, never assume all lenders will underwrite a great Va loan document which have an excellent property Becoming Computed otherwise TBD. It even more very important action is significantly regarding really works, and it will perhaps not build a sealed mortgage since there is maybe not possessions but really. It’s been an unneeded extra step. not, getting Virtual assistant consumers that have marginal borrowing the excess effort is extremely demanded while the credit reports had been reviewed of the underwriter.

Instead of a prequalification, good preapproval is determined from the real Va financing underwriter’s done post on the new borrower’s documents, besides counting on what commonly only discussed towards the cell phone between your debtor and you may financing manager. Lower than, we are going to talk about the steps to get an excellent Va mortgage preapproval…not only an effective Va financing Prequalification.

View this brief videos having a fast factor of one’s change anywhere between a beneficial Va Financing https://clickcashadvance.com/personal-loans-co/ Pre-Approval vs. an effective Virtual assistant Mortgage Pre-Qualification:

Va Financing Prequalification

When a seasoned gets pre-eligible to a beneficial Va home loan, they have been available with an offer of your own mortgage size they will have the ability to get to. Such estimates are supplied according to first advice the newest Veteran brings, often from a highly short term conversation that have financing administrator. That it dialogue and additionally cannot necessitate a credit check. A clear confirmation of one’s borrowing character and you will credit ratings are always needed, especially for Regulators loans such an excellent Va loan.

Consider a good Virtual assistant mortgage prequalification because earliest minimal step and this possibly could happen up until the real Virtual assistant financing preapproval into the the newest homebuying procedure. You can just get a standard feeling of the purchasing stamina following begin in search of a house. However, taking the even more procedures are usually must expose a great experience of a professional bank that will next topic a powerful letter indicating their official certification since a beneficial Va visitors.

When you find yourself asking ways to get preapproved to own an excellent Virtual assistant domestic loan, we’re going to deliver the six short & simple actions right here:

Pre-Approval vs Pre-Qualification: Essential Technology Variations!

Many industry participants and you can individuals make use of the conditions pre-approval and you may pre-qualification interchangeably, there are lots of crucial differences to keep in mind.

A Va mortgage Prequalification generally is performed by the a loan manager, hence passion might or might not were a credit assessment an enormous feature on the recognition process. Debt in order to earnings percentages tends to be calculated during this craft, but count on cannot be placed on a leading obligations ratio condition without using the industry standards of Automatic Underwriting.

There’s no solution to this task. A staff on bank have to obtain a great tri-blend credit report additionally the ensuing credit scores of all of the three credit reporting agencies. Unfortunately, the new AUS or Automated Underwriting System can be work at of the any employee at the bank, although ethics and you will validity of the Automated Underwriting Research show need to be confirmed of the a good Virtual assistant Underwriter. The latest AUS application most frequently put is known as Pc Underwriter.

A great amount of errors can be produced within this procedure of the inexperienced users, but those fatal mistakes would be bare of the underwriter That is what They are doing! Incase the new mistake truly is actually fatal, the mortgage will be denied. When you’re in the escrow to acquire, it is not a lot of fun to ascertain you don’t qualify!

A highly high most of the fresh Virtual assistant financing Preapproval answers are taken to borrowers from the financing officers utilising the AUS application by themselves, most rather than supervision. An alternate user of this tool normally learn how to work the software within just hours and become quite fluent within just months.

A word-of Caution…as an enthusiastic unknowing Virtual assistant borrower, you would not know if which member possess integrated deadly errors. You can now type in the details on application! Every borrows are not the same. That civil paystub is going to be simple, and many are notoriously complicated, just as are a couple of self-employed tax returns. Hence, errors on earnings, obligations rations, continual income conditions and can easily be area of the preapproval.

This really is an old rubbish when you look at the, garbage out circumstances, where in fact the result is merely as good as sensation of the application agent. If the an unskilled mortgage officer tends to make a mistake and you may provides a good Va loan preapproval page to you personally, it may not feel reputable, top your down a sad roadway, oriented getting trouble.

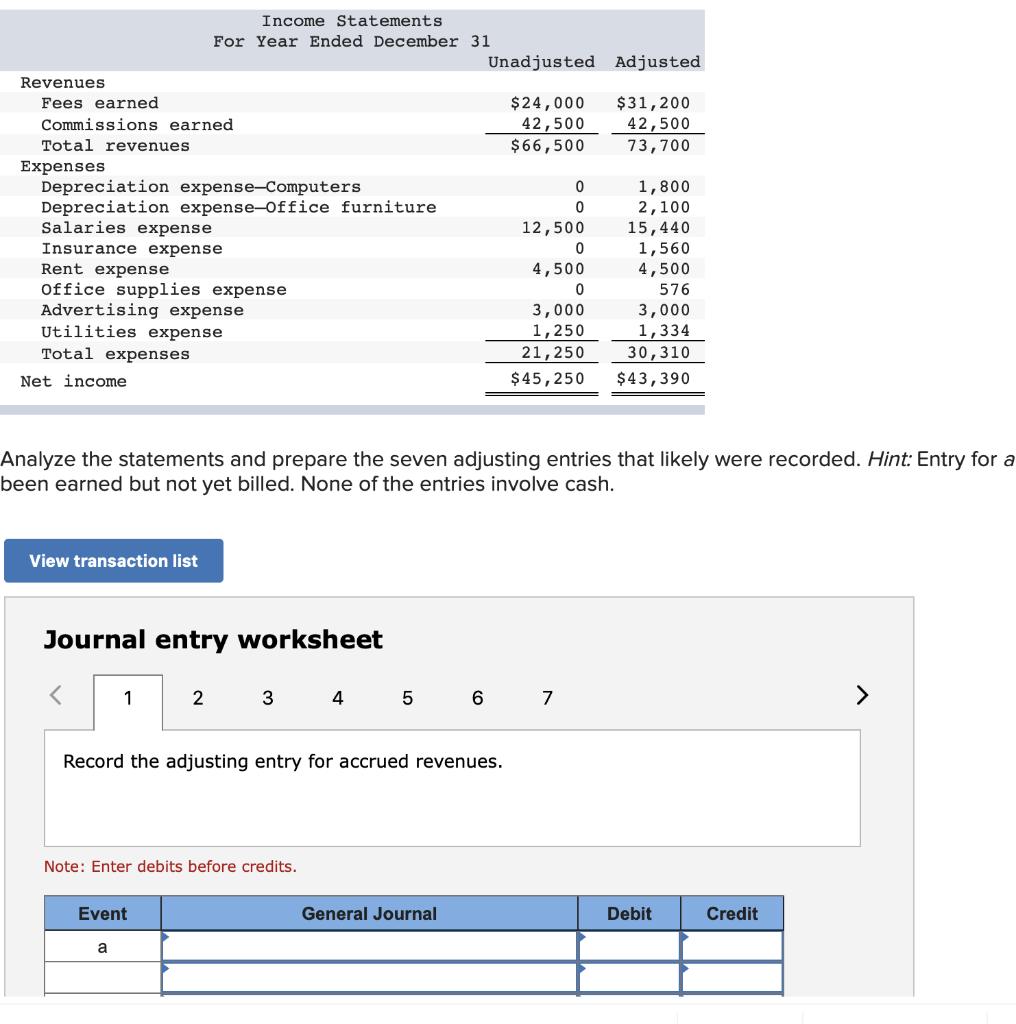

Pre-Approval compared to. Pre-Degree Graph

The following graph will fall apart the differences between pre-certification and you can pre-recognition if you’re reacting particular faqs concerning the Virtual assistant house financing processes:

Within SoCal Virtual assistant Property, the audience is invested in supporting you through the Va financing prequalification processes all the way to a great TBD pre-acceptance, when necessary. I beat to truly get you securely accredited and you may making their even offers attractive! I make the process smoother and send better results with our unique and you may strong applications.

Virtual assistant Mortgage Prequalification Calculator

I’ve several hand calculators to greatly help the preapproval for a beneficial Va home loan. Our Virtual assistant mortgage calculator helps you imagine costs. And you will the other calculator can serve as a great Va home loan prequalification calculator, as it reduces any profit and you may demonstrates to you the debt percentages.

Ensure you get your Va Home loan Preapproval Today!

Sr. Virtual assistant Loan Positives is actually here to help you last, in addition to Peter Van Brady which authored the important publication towards the Virtual assistant loans: To stop Mistakes & Crushing Your Sales Using your Virtual assistant Financing.