- Introduction

- Kind of pool money

Associate hyperlinks toward affairs in this post are from couples one compensate all of us (see the advertiser disclosure with your range of lovers for lots more details). not, the opinions is our very own. Find out how i price unsecured loans to enter unbiased ratings.

- Adding a swimming pool to your residence can be one of new most costly programs you deal with.

- Financial support possibilities tend to be pond loans, house collateral, otherwise funds through the contractor or company.

- Another pond might create from around 5% to eight% with the Oregon installment loans house’s full really worth.

As to the reasons purchase a share?

A patio pond is boost the enjoyment you earn out of your home and boost the well worth at the same time. Although not, adding a swimming pool is just one of the more costly house-upgrade plans you might accept.

House security loans and you will HELOCs

Property security mortgage was an option for financing your own pond. This will be ideal for those who have extreme guarantee based right up in their belongings. With a property collateral mortgage, your obtain a lump sum payment according to the value of your home, without having the balance towards financial. Your property serves as collateral into mortgage. The new installment conditions into the a home collateral financing ranges of five so you can 30 years, therefore the interest rate could be fixed.

However, it is vital to keep in mind that defaulting into a property equity loan could result in property foreclosure, so it sells significant exposure.

Such as a property equity loan, a property collateral credit line (HELOC) leverages new security collected on the home. Experiencing their home’s security that have an excellent HELOC is much like using a charge card, even when good HELOC only covers a predetermined period of time, known as the draw several months. HELOCs usually have varying rates of interest plus the fees terms is also be longer than that of house equity financing.

Note that the mark months will get last for much longer compared to pond setting up, while you will face a lot more fees for closing the collection of borrowing from the bank early. It is additionally vital to note that interest rates to the an excellent HELOC, which means that monthly payments, is change over the years.

Unsecured personal loans

A pool loan are a popular option for money a pool. It is a consumer loan you to definitely a lender segments especially since the a method to purchase the acquisition and installing an excellent pool.

Because they are signature loans, you could potentially obtain a swimming pool loan regarding a financial, borrowing from the bank relationship otherwise on the web lender. Any kind of bank you select, you are going to discover a lump sum as you are able to set on the this new pool and you may pay in repaired monthly payments, that have focus, more than a specified title.

“Pool fund typically have a phrase of five to 15 years, to the interest rate fundamentally contingent with the borrower’s credit history,” says David Krebs, a mortgage broker within the Fl. “A score of 650 or even more is oftentimes desired getting better rates.”

You will get a pool mortgage the same exact way you get a personal bank loan for any other mission. Of several loan providers can help you prequalify for a financial loan which have zero affect your credit rating, allowing you to comprehend the rates and you will terms he’s probably to offer before you could complete aside an entire app.

Pond money due to pool companies

Certain pond brands otherwise investors bring resource straight to people. They may features partnerships that have lending institutions otherwise offer for the-house financing choice. Exactly like contractor funding, a loan build through a plant otherwise specialist also have a good streamlined processes as the resource was included to your pool pick.

However, a comparable caveats pertain. It is critical to very carefully review the new terminology, interest rates, and you may charges with the financial support offerparing also offers off other firms or investors and you will investigating most other money alternatives can help you see the best deal.

Builder financial support for your pond

Many pond builders give their own financing options to help people pay for their pond set up. These software are generally setup using partnerships having credit establishments. Builder resource are going to be a handy option because company protects the program procedure plus the mortgage conditions, but people should be cautious because there is the possibility of problems interesting.

Comparing choice

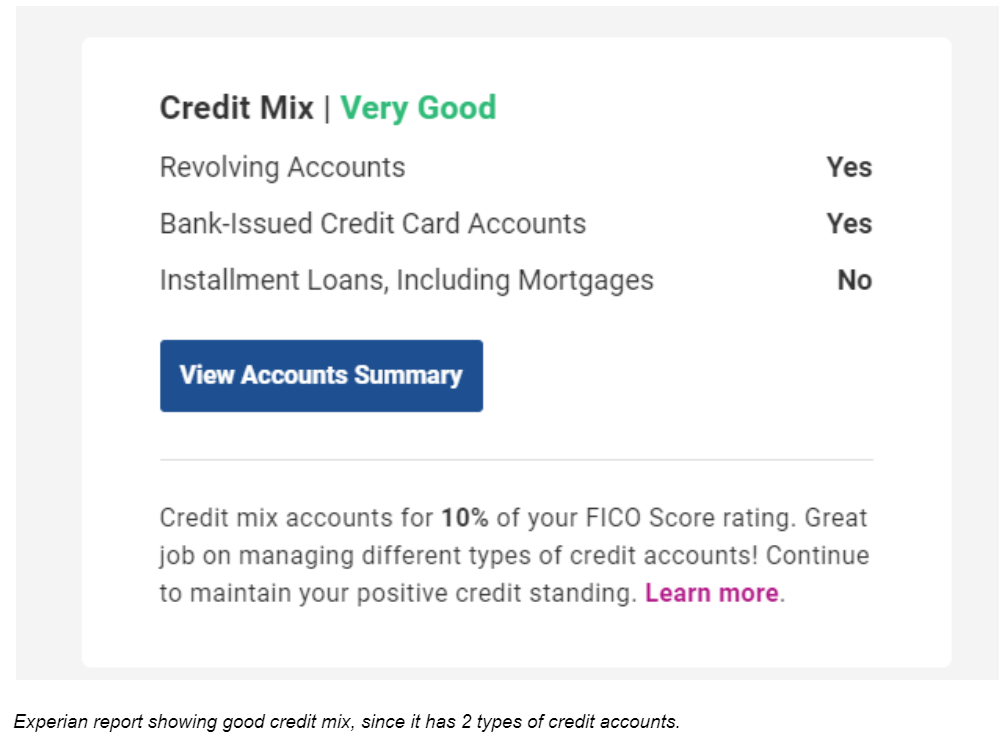

To qualify for a pool mortgage you normally need a credit rating regarding 650-680. When you have a top get you might usually get more advantageous terminology, instance all the way down interest rates. It’s crucial to carefully opinion the conditions and terms, as well as interest rates and you will costs, to make sure you are receiving a great contract.

Financial support options are a lot more minimal that have poor credit, however some loan providers bring unsecured personal loans with high rates for these sorts of individuals. As well, pond companies have investment arrangements one accommodate a broad assortment regarding borrowing from the bank profiles.

Home collateral finance generally promote straight down rates of interest because they are shielded facing your house. Unsecured unsecured loans, at the same time do not require collateral, and can even function as preferable selection.

Investment conditions differ by the lender, but home guarantee funds and you will HELOCs might have words around two decades. Unsecured unsecured loans often have shorter terminology, anywhere between 2 to help you 7 ages.

Certain bodies pool finance is actually rare, however might find options for times-efficient or “green” swimming pools one to qualify for unique funding. You might look for rebates around local government opportunity-saving software.

Prior to investment a swimming pool, consider the total cost in addition to repair and you will insurance rates, how pond usually affect property value, and you can if excitement and employ of one’s pond validate the brand new financial support.